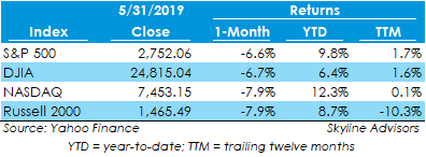

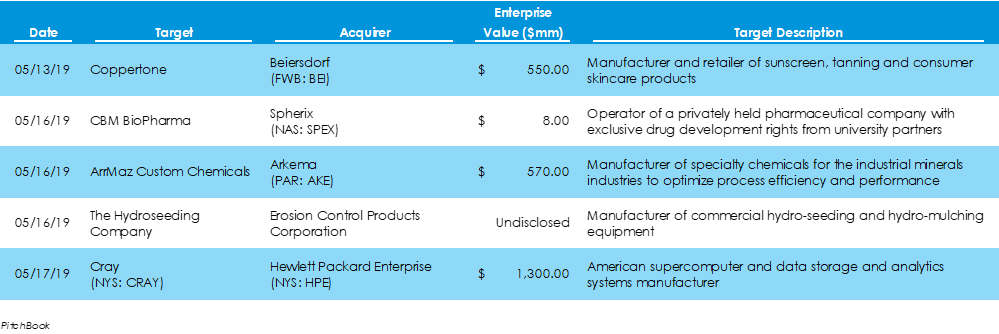

Stock markets dropped in May due to the on-going trade tensions with China. The S&P 500 dropped 6.6% to 2,752, while the Dow Jones Industrial Average, NASDAQ, and Russell 2000 each declined 6.7%, 7.9%, and 7.9%, respectively. May marked the first month of broad index declines for the year, though returns are still up considerably year to date. Disney Claims Control of Hulu Ahead of Disney+ Streaming RolloutPitchbook data reveals that $9.5 billion was invested across 27 M&A deals in the U.S. last week, 6 fewer deals and $75 billion less capital after outsized M&A activity in the week prior. Two deals – targets Cray and Hulu - were in the billion-dollar range. The Walt-Disney Company acquired full control of Hulu for $5.8 billion, after what once was joint ownership by Disney, 21st Century Fox, Comcast, and Time-Warner.

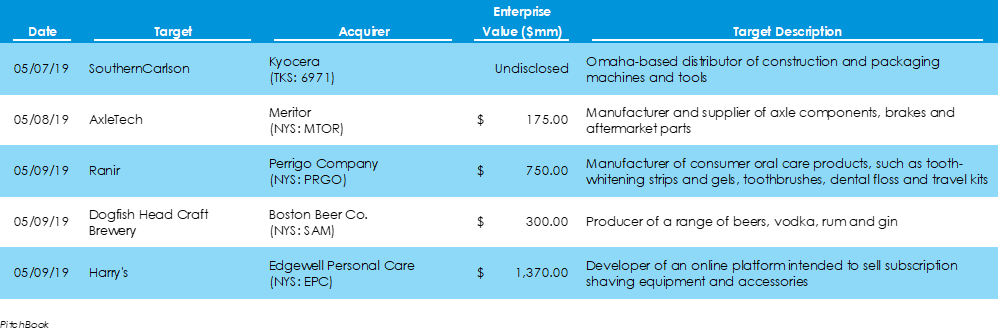

Maker of Samuel Adams Buys Delaware Craft BreweryData from Pitchbook shows that $84.5 billion was invested in 33 deals across American M&A markets last week, 10 more deals and $71.1 billion capital than the week prior. Four of those deals were for over $2.5 billion, including $38-billion and $23.3-billion-dollar deals, both of which were in the energy space. Another deal that caught significant media coverage was that of Boston Beer Co., the brewer of Samuel Adams brand beers, which paid $300 million to acquire Dogfish Head Brewery, a craft beer maker from Milton, Delaware. Dogfish produces over 250,000 barrels of beer annually.

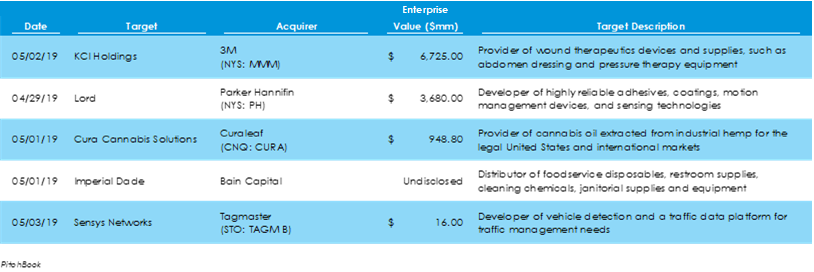

Chevron-Occidental Bidding War for Anadarko Heats UpPitchbook data reveals there were 23 deals for $13.4 billion invested capital in M&A markets last week. That is $9.8 billion more capital than the week before on two fewer deals. Two billion-dollar deals, 3M’s acquisition of KCI Holdings and Parker Hannifin’s acquisition of Lord, drove the increase in value from last week, contributing $6.7 billion and $3.7 billion, respectively, to the increase. M&A news was encapsulated by Occidental Petroleum and Chevron’s bidding war for Anadarko Petroleum and their Permian Basin shale-oil fields. Warren Buffett has committed to financing $10 billion of Occidental’s bid.

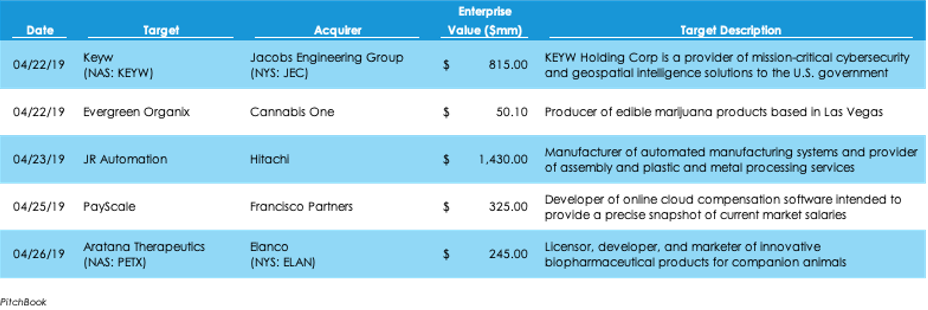

Cannabis M&A Spiked Last Week with Four Deals in the U.S.Pitchbook data shows M&A activity slowing last week, with $3.6 billion invested across 24 deals, $11.2 billion capital and seven deals fewer than the week prior. Japanese multinational conglomerate Hitachi shelled out $1.43 billion for Michigan-based industrial robotics integrator JR Automation in the week’s largest deal. Deal making in the cannabis space was hot last week, with four U.S. cannabis producers and distributors being acquired.

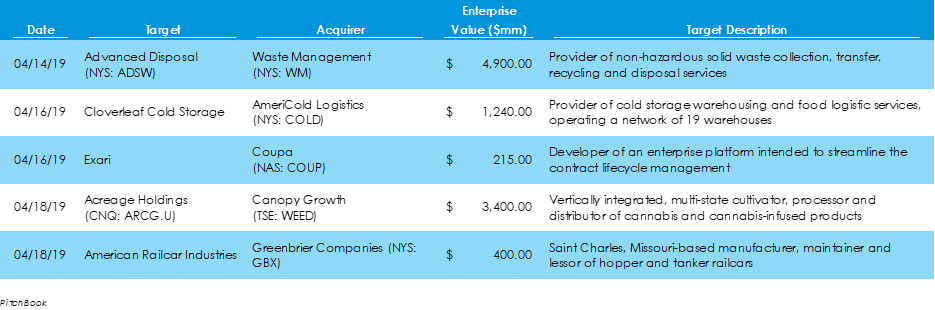

Waste Management Grows Eastern U.S. Operations by Acquiring Advanced Disposal Data supplied by Pitchbook reveals that $14.8 billion in capital was deployed across 31 M&A transactions last week, four deals more and $28.8 billion less capital than the elevated levels of the week prior. The largest deal of the week was Waste Management’s $4.9 billion acquisition of Advanced Disposal, which will help expand the nation’s largest waste collector’s East Coast operations. Also, Canopy Growth announced a deal to acquire Acreage Holdings once cannabis is federally legalized in the U.S.

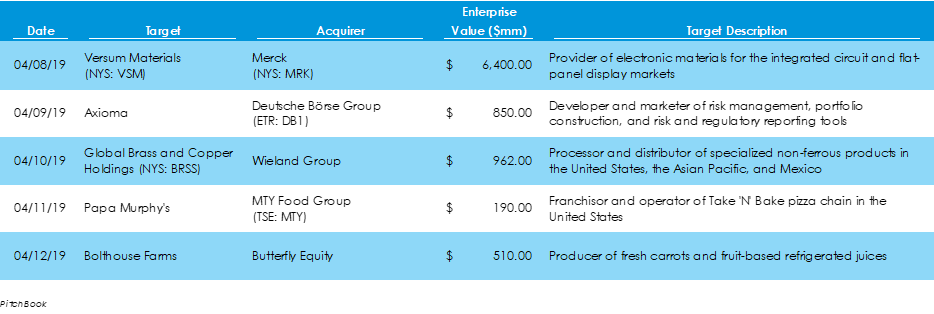

Campbell’s Soup to Sell Bolthouse Farms Brand in Refocusing Effort Pitchbook data reveals that $43.6 billion in capital was spent on 27 M&A deals throughout last week, $28.4 billion more capital than the week before but on two fewer deals. Chevron (NYS: CVX) shelled out $33 billion to acquire Texas-based Anadarko Petroleum (NYS: APC) in the week’s largest deal.

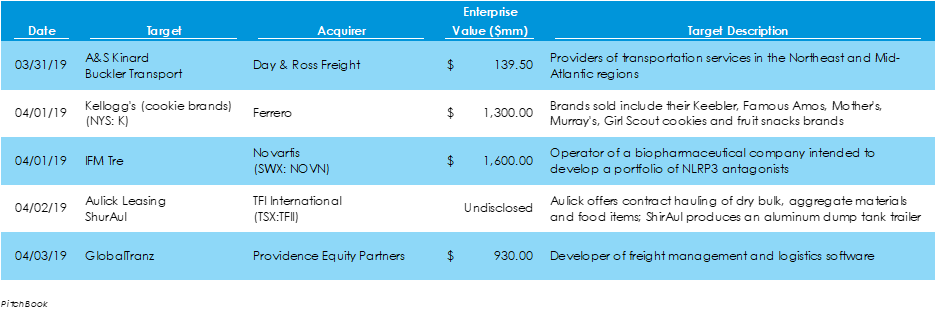

Transportation Space Highlights Last Week’s M&A ActivityData from Pitchbook shows that $15.2 billion of capital was invested across 29 M&A deals last week, $4.4 billion less capital on two more deals than the previous week. The largest two deals during the week were Stonepeak Infrastructure Partners’ $3.6 billion LBO of Oryx Midstream Partners and the $2.44 billion acquisition of AmeriGas Partners by UGI Utilities. AmeriGas is a publicly traded propane distributor, and Oryx is a natural gas collection group. The transportation space was an active sector, as A&S Kinard and Buckler Transport were acquired by Day & Ross Freight; TFI International acquired Nebraska-based Aulick Leasing and its manufacturing business, ShurAul; and Providence Equity Partners acquired transportation software provider GlobalTranz.

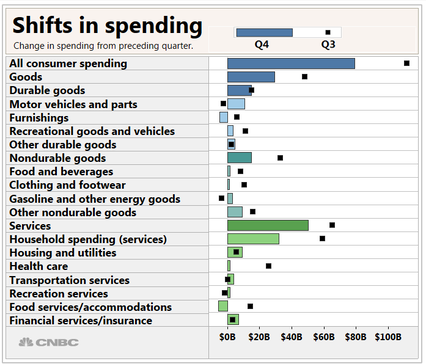

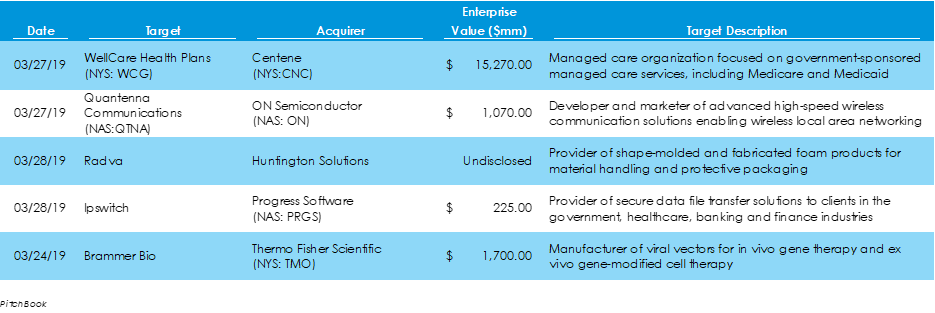

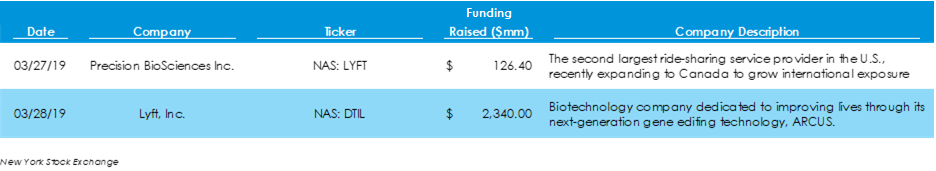

Mergers & Acquisitions: Manufacturing Sector Sees Continued Strong Activity in the M&A SpacePitchbook data reveals that $19.6 billion of capital was invested across 27 M&A transactions last week, twelve more deals but $17.2 billion less capital than in the week prior. The largest deal was publicly traded Centene’s corporate acquisition of WellCare Health Plans, also a publicly traded company, for $15.3 billion. The manufacturing vertical has been busy in 2019 through the end of last week, posting 48 transactions and $19 billion capital invested in LBOs and corporate acquisitions. Initial Public Offerings: Lyft Follows Through with Long-Awaited IPO According to the New York Stock Exchange website, two companies went public last week, the same figure as the week before. However, those two companies, Lyft and Precision BioSciences, combined raised more than in the prior week, raising $2.3 billion and $126 million, respectively. Lyft has been a highly anticipated IPO since the beginning of 2018, and the results of its IPO are indicative of it. The company priced its IPO at $72 per share, well above its initial estimates after a roadshow in which the firm received commitments in excess of expectations. As of trading close on Friday, Lyft was valued at approximately $26.5 billion. Economy: U.S. Fourth Quarter Economic Growth Revised Downward Among news last week:

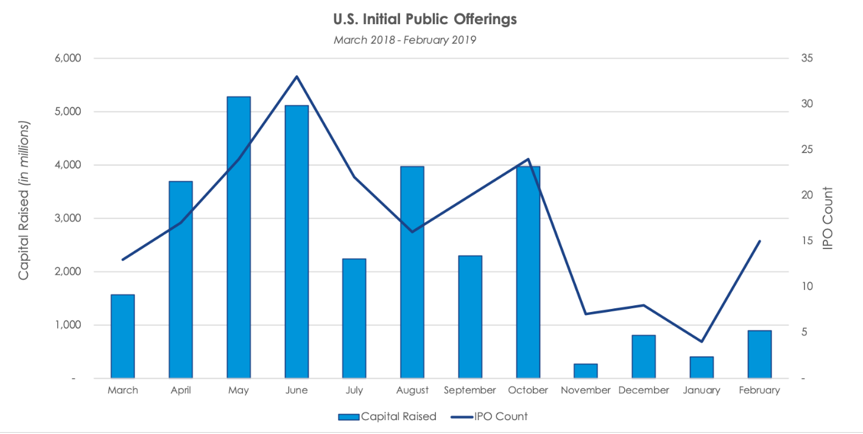

Activity for initial public offerings remained at low levels in February, with 15 U.S. companies going public, raising a total of $887 million in capital. IPO fundraising is down 72.9% from last February and Is down 90% to $1.3 billion for the first two months of 2019 compared to the first two months of 2018. The end of 2018 and beginning of 2019 are well off of recent highs set in the early summer last year. However, month-to-month, the trend has shifted upward, rising 120% from the $403 million raised in January.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed