|

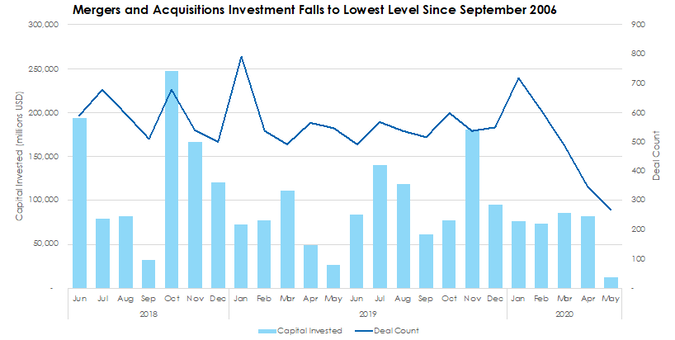

M&A activity continued to pick up in July, according to preliminary data from Pitchbook. In the US, there was more than $50 billion in M&A spending, the second month of increases from May’s low. While deal counts are currently showing a sequential decline from June, we suspect there will be an increase as deals are reported (there tends to be a lag in deal reporting). We continue to monitor M&A volume, which is supported by the reopening of economies across the nation but is under pressure from rising COVID-19 cases.

Download our Second Quarter 2020 Mergers & Acquisitions Update

As economic shutdowns persisted into the second quarter, it is unsurprising that mergers and acquisitions (M&A) activity further stalled in the quarter. Deal volume in the US declined approximately 42% while spending on M&A deals fell 25% from the first quarter. The quarter demonstrated that there was extraordinary uncertainty in the market. Midwest M&A activity trended similarly to US activity, with the number of deals completed falling slightly more than 50% from the first quarter.

Download our Second Quarter 2020 Economic & Public Market Update

The second quarter was a challenging quarter on the economic front. The nationwide, COVID-related shutdown from the first quarter segued into the second quarter, and the Government issued an unprecedented fiscal stimulus package in order to keep the economy afloat. American job losses continued to reach numbers never seen prior to 2020, and the flow of money slowed (while personal savings increased to a record). As the quarter proceeded, state and local economies began to reopen, and consumers and businesses alike began to show some signs of life: jobs in hard-hit segments, such as hospitality, showed significant growth; manufacturer surveys optimistically showed expectations of growth; and both existing home sales and housing starts trended positively.

We’ll release full capital market activity reports in the coming weeks, but, in the meantime, we wanted to provide preliminary information on how the quarter ended. As shown in the chart below, national merger and acquisition (M&A) activity in June rebounded from relatively abysmal May activity. This preliminary data from Pitchbook is still generally lower than pre-COVID levels but is a promising sign of forward progress as deals take time to move through the pipeline.

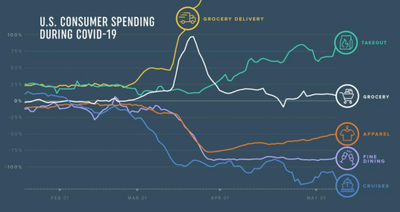

We are all aware that the “corona-conomy” has been bad for certain businesses while it has been mediocre or even good for others. But these generic labels are typically very binary and tend to imply the extremes. The true impact on individual sectors tends to vary significantly from the average. Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

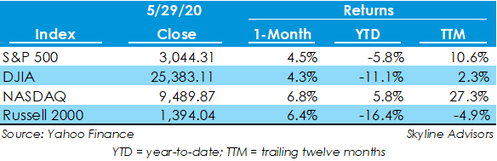

Stock Markets Stage Sharp Rebound in May  Easing of quarantine restrictions and hopes for a vaccine gave US equities a boost during May, adding on to strong year-to-date performances in large cap indices. Year-to-date, the S&P 500, Nasdaq, and Dow Jones gained 10.6%, 27.3%, and 2.3%, respectively, while the Russell 2000, a small cap index, is down 4.9%. In May alone, the large cap S&P 500 and Dow Jones gained 4.5% and 4.3%, and the tech-heavy Nasdaq and small cap Russell 2000 gained 6.8% and 6.4%, respectively. Optimism surrounding reopening economies supported equities during May.

Venture capital (VC) activity showed more money being invested in fewer deals during the first quarter (Q1), continuing a trend seen in recent quarters. Overall deal count slowed 18%, while aggregate deal volume increased 10% from the fourth quarter to $34 billion. With the onset of the coronavirus impacting markets and the economy in the latter half of Q1, VC activity is expected to show further slowing in the second quarter.

In the first quarter (Q1), the global economy was brought to a halt as a result of the spread of coronavirus (COVID-19) and its ripple effects. Whereas general merger and acquisition (M&A) activity began to decrease in the first quarter (see M&A results here), private equity (PE) firms continued to make use of their record-high levels of dry powder. PE investments were up an estimated 6% by volume year over year in Q1, and valuation multiples were higher than the averages for each of the prior ten years (see page 7).

As the world struggled to contain and understand the full impact of the coronavirus (COVID-19) pandemic in the first quarter, the main economic impact (see our summary here) did not manifest itself until the second half of March. It is unsurprising, given the sudden stop, that merger and acquisition (M&A) activity echoed general economic trends, particularly in light of the uncertainty surrounding how long restrictive measures would remain in place and whether there would be a “V-shaped” recovery.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed