|

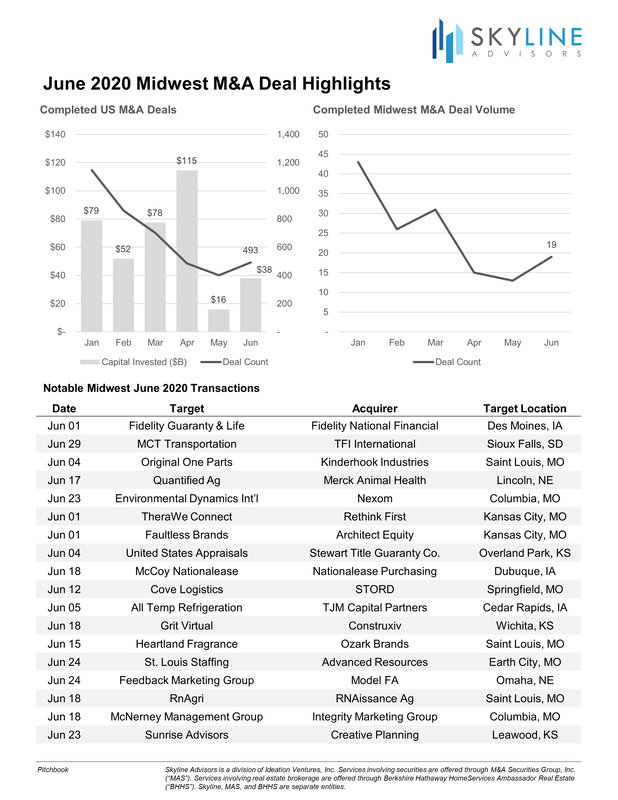

We’ll release full capital market activity reports in the coming weeks, but, in the meantime, we wanted to provide preliminary information on how the quarter ended. As shown in the chart below, national merger and acquisition (M&A) activity in June rebounded from relatively abysmal May activity. This preliminary data from Pitchbook is still generally lower than pre-COVID levels but is a promising sign of forward progress as deals take time to move through the pipeline.

The trend in the number of Midwest deals generally followed the national trend over the first half of the year. Nineteen (19) deals were estimated to be completed in the Midwest in June, representing $1.81 billion of transaction value. The largest, and vast majority of the aggregate deal value for the month, was Fidelity National Financial’s purchase of Fidelity Guaranty & Life. The Midwest saw a concentration of automotive and transportation/logistics deals, including deals for MCT Transportation, Original One Parts, McCoy Nationalease, and Cove Logistics. The table below highlights some of the other notable M&A transactions within the six-state Midwest region during June.

If you are not already on our newsletter mailing list, you can complete the signup form below to receive periodic capital market updates, beginning with our upcoming reports on second quarter (Q2) activity for mergers and acquisitions, public market valuations, venture capital, and private equity.

Stay Informed...

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed