|

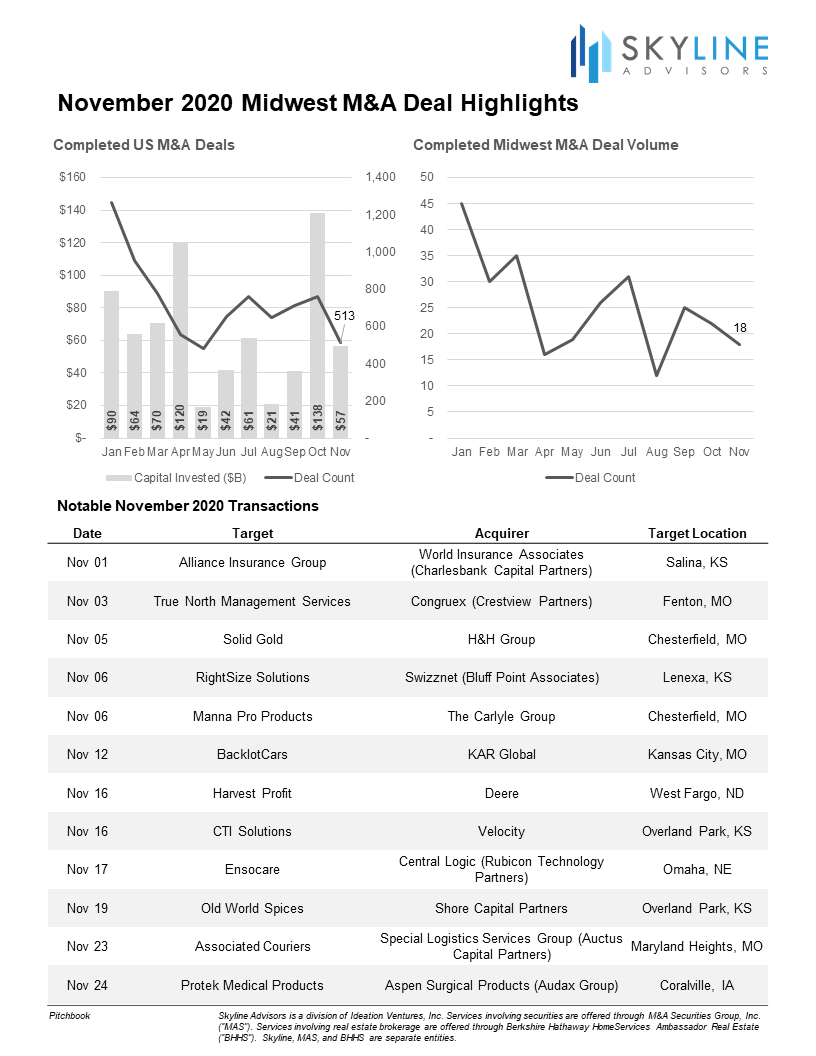

According to preliminary data from PitchBook Data, there were 513 US mergers and acquisitions in November, accounting for approximately $57 billion in total consideration. As we noted in our October 2020 Highlights post, Bloomberg reported a substantial increase in M&A volume before the election; however, those deals were simply announcements and may take time to close. M&A trends generally continue to reflect several factors outlined in our September post that have slowed acquisition activity, but we expect that later reporting of deals will support a healthy increase in November’s figures. (With respect to delayed reporting, an example is that when we posted October’s preliminary data, there was a total of $115 billion spent across 643 deals. This has since been updated to $138 billion across 762 deals and will likely continue to increase as new deals are reported.)

In the Midwest, a preliminary estimated 18 deals were closed, highlighted by The Carlyle Group’s acquisition of Chesterfield, Missouri-based Manna Pro Products and Deere’s purchase of Fargo, North Dakota-based Harvest Profit. As of this writing, there were eight announced M&A deals in the Midwest outstanding, including Casey’s General Stores’ $580-million acquisition of Omaha-based Buchanan Energy (the Bucky’s c-store chain). Deal-making activity is anticipated to pick up in 2021, as political uncertainty becomes clearer after the election, including an expectation that there is likely to be additional stimulus measures, and with increasing optimism surrounding COVID-19 vaccines. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed