|

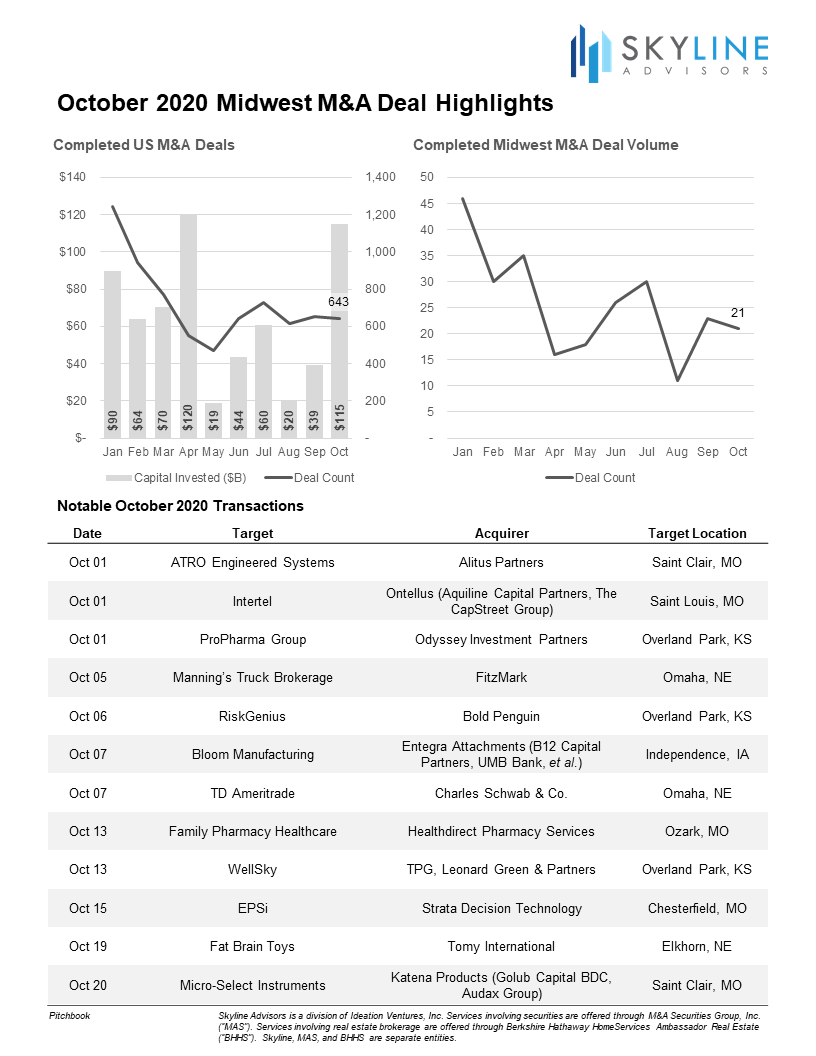

Though deal volume was relatively unchanged in October, overall consideration spent on acquisitions ballooned during the month, climbing approximately 194% from September to $115 billion in October. Four deals amounted to over $10 billion: the acquisitions of TD Ameritrade ($22 billion), Immunomedics ($21 billion), E*Trade ($13 billion), and Noble Energy ($13 billion). The surge in consideration amid flat volume reiterates that buyers are willing and able to pay more for large, higher-quality targets. Furthermore, there appeared to be a rush of announced transactions ahead of the US election, with Bloomberg estimating more than $140 billion in M&A value announced globally in the week preceding the election – the most for any week prior to a US presidential vote since Bloomberg tracked the data. We believe M&A activity among lower middle-market and middle-market companies continues to be impacted by factors we highlighted in our September 2020 Midwest M&A Highlights.

In the Midwest, there were 21 deals announced, slightly down from September’s 23 deals. However, it is important to note that there is often a lag in deal reporting, which may potentially carry October’s eventual deal count above that of September. For context, when we reported September’s Midwest M&A activity, there were 14 completed transactions reported. As of this writing, that figure has been adjusted to 23. Thus, October does appear to be trending ahead of September on an apples-to-apples basis. Over the coming months, the pandemic is expected to continue to have downward pressure on deal activity. However, this could be potentially offset by optimism for vaccines, potential additional stimulus measures, and the fact that PPP loan recipients now have a clearer pathway to closing transactions. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed