Volatility Again Creates Uncertainty in the IPO Market, Potentially Delaying Major 2019 Debuts12/1/2018

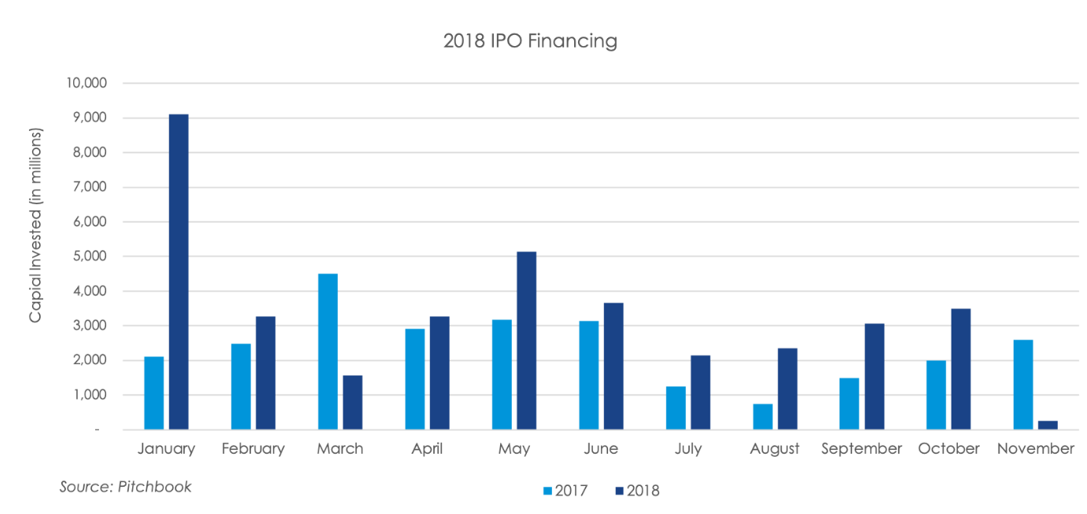

According to preliminary data provided by Pitchbook, only six firms went public in November 2018, raising a total of $262 million in funding. Total IPOs and funds raised are down 68.4% and 92.5%, respectively, from October. Furthermore, there were three less IPOs this November than one year prior and 80% less capital raised. For 2018 through the end of November, the 160 companies that have gone public have raised $37.4 billion. That is a 114% increase in fundraising and a 214% increase in newly public companies from 2017. The healthcare sector continues to produce IPOs this year, with 37.5% of all IPOs being healthcare and biotech companies. Financial service companies have also seen a bulk of IPO activity with 33 firms going public.

Volatility continues to contribute to market uncertainty, thereby reducing the number of firms willing to follow through with IPO plans at this time. Despite much discussion about a flurry of 2019 tech IPOs, including the likes of Uber, Lyft, AirBnb, and Pinterest, the recent market shake-ups may delay their plans until further into 2019. According to Yahoo! Finance, through the first week of December, IPO shares have, on average, jumped 13% from pricing to the opening of trading. However, firms that went public in November only saw a 0.2% average spike, the weakest reception of IPOs since November 2016. Uber and Lyft have already filed preliminary paperwork with the SEC, signaling a target for first-quarter IPOs. However, if the shakiness in markets spills into 2019, tech IPOs could be delayed into the second-quarter. The close timing of the filings for the ridesharing giants may show that each are feeling pressure to be the first to market next year. For both firms, especially the smaller Lyft, being second-to-market could mean missing out on public money available from investors who are eager to invest in the ride-sharing business. The highlights from our weekly IPO market updates during November 2018 included: Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed