|

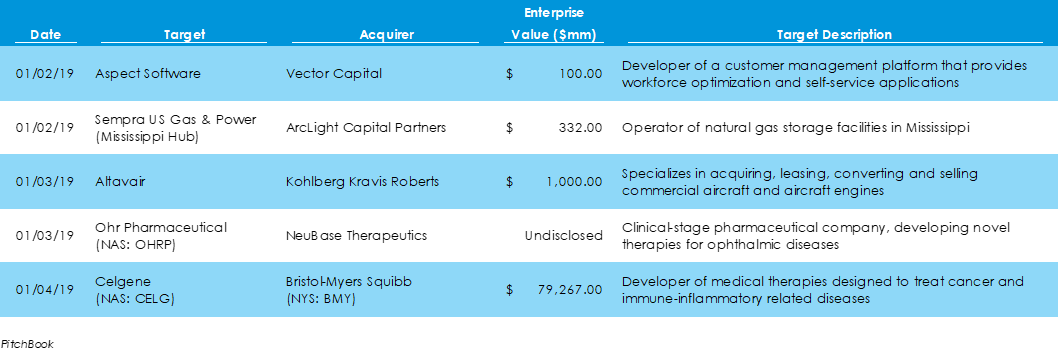

According to preliminary data supplied by Pitchbook, there were twelve M&A deals in the first week of the new year, totaling $80.97 billion. However, almost all of that value comes from Bristol-Myers Squibb’s $79.3-billion buyout of cancer and anti-inflammatory medication maker Celgene. The week also featured two leveraged buyouts: KKR’s $1-billion LBO of Altavair, a provider of airline acquisition and leasing services, and ArcLight Capital Partners’ $332-million acquisition of Sempra U.S. Gas & Power’s Mississippi hub of natural gas storage tanks.

One of the largest deals announced in 2018, the $26-billion merger of T-Mobile and Sprint, has been put on hold. The government shutdown continues as the two firms await FCC approval. This is the second time in four months that the deal has been halted, the first following the submission of additional documents for which the agency needed more time to review. The FCC typically monitors a 180-day “shot-clock” regarding the timing of its deal reviews, which is paused from time-to-time to allow for comprehensive review of materials. The two companies were hoping to complete the deal in the first quarter, but as the FCC review gets drawn out, the firm is expecting a second quarter close. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed