|

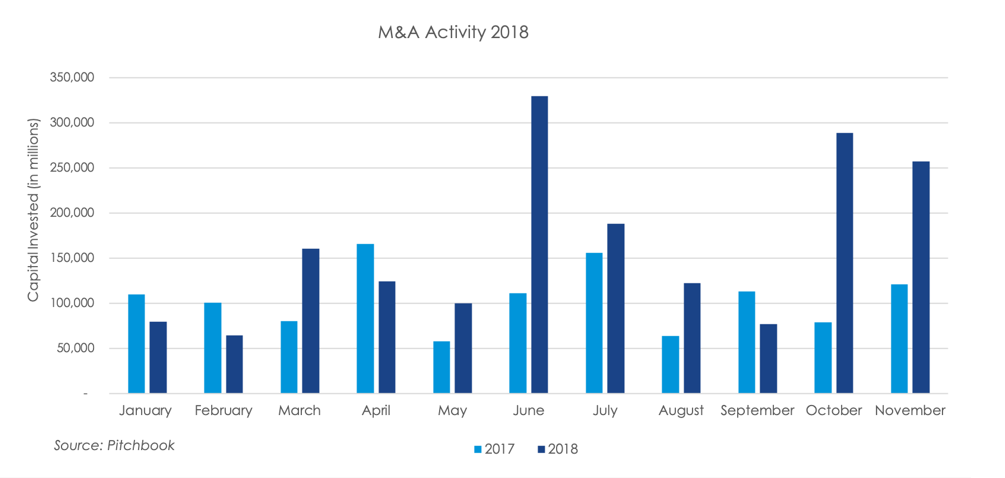

Following the late summer lull in July, August and September, spending on mergers and acquisitions has sustained its spike from October. M&A spending of $257.5 billion in November fell 10.9% from October’s spending, but is still up 58.4% on the trailing three-month average. The closing of a number of large deals drove spending numbers higher, including CVS’s $70-billion buyout of Aetna and Broadcom’s $19-billion acquisition of CA Technologies. According to preliminary data from Pitchbook, 708 deals took place during the month, with Industrials fetching most attention with 111 deals totaling $60.8 billion. Another 19 transactions involved targets in the cannabis industry. The most active region in November was the Mid-Atlantic region, which includes Delaware, D.C., Maryland, New Jersey, New York, Pennsylvania and Virginia. The region totaled 156 deals and $36 billion invested.

According to Merrill Corporation and Acuris, globally, M&A value dipped lower in November, ending a streak of four straight months with year-over-year increases. The report suggests that unsteady geopolitical conditions and tumbling asset prices are responsible for the decline in activity. Merrill and Acuris also conclude that a total of $3.3 trillion spent on M&A this year is the second highest mark in the post-crisis economy, trailing only 2015’s $3.9 trillion. For the U.S., buyout value more than tripled compared with one year earlier, a demonstration of the continued strength of the buyout market in North America. The highlights from our weekly M&A market updates during November 2018 included:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed