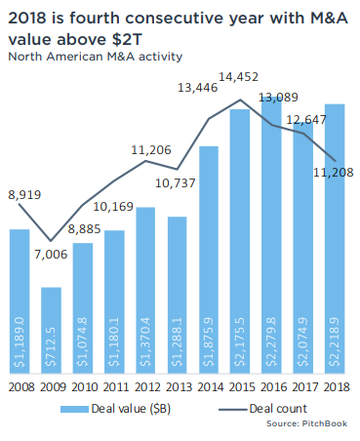

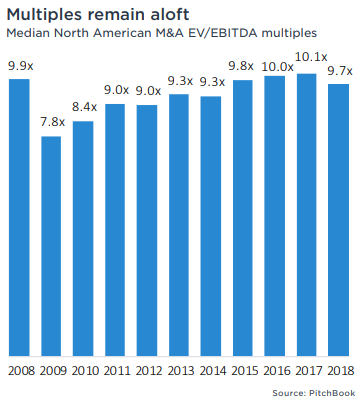

North American M&A value topped $2 trillion for the fourth consecutive year in 2018, with a total value of $2.2 trillion, an increase of 6.9% from 2017, according to Pitchbook. The number of deals completed in 2018 totaled 11,208, down 11.4% from 2017’s 12,647. The median deal size in North America increased 22.4% to $60 million in 2018.  Valuations edged down in 2018, falling to a median value of 9.7 times earnings before interest, taxes, depreciation, and amortization (EBITDA) from 2017’s 10.1x. The trend in valuations on private-equity-led deals was similar, falling to a median multiple of 11.6x from 11.9x last year. 2018 marked a first for the number of information technology deals outnumbering business-to-consumer deals. The year also marked the highest volume of $100M+ deals in Pitchbook’s records. Pitchbook analysts are carefully watching leading economic indicators in 2019, as 2018 closed amid fears of a cooling economy. Businesses may curtail expansion plans and preserve cash, which may further limit economic growth. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed