|

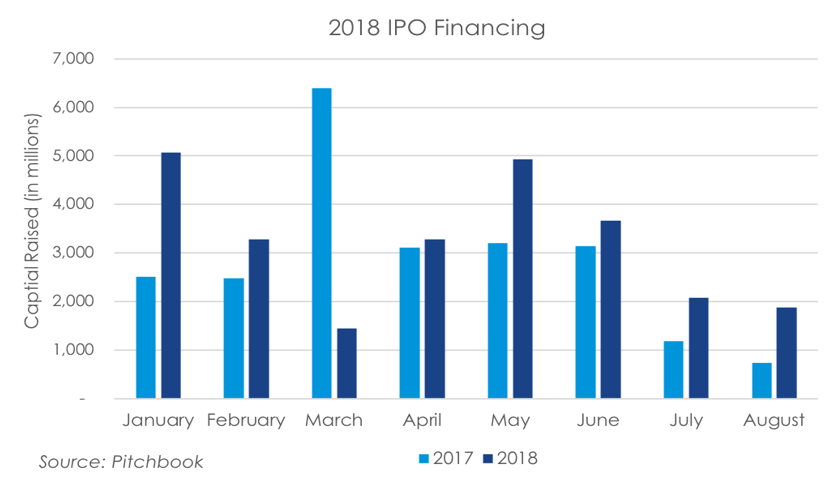

For the month of August, nine U.S. companies made debuts on American stock exchanges, raising a combined $1.88 billion, according to data from Pitchbook. The figures are down slightly from July, when there were 15 IPOs totaling $2.08 billion in capital raised. As for the calendar year-to-date, $25.6 billion has been raised through 117 IPOs, up from the $22.7 billion raised in the same period of 2017. According to Renaissance Capital’s U.S. IPO Index as of August 30th, IPO stocks have slightly underperformed the S&P 500 this year. The index, which tracks a basket of the most liquid newly trading public companies, is up 9.49%, 42 basis points lower than the S&P 500.

The business-to-consumer industry had five of the nine IPOs in August, raising $1.33 billion in capital. This marks the first month of the year that healthcare hasn’t been the leading industry in terms of capital raised from public issuances, ($66 million in capital raised among two IPOs). In 2018, financial services have also had busy IPO activity. The industry is responsible for 18.8% of IPOs in the U.S. and $5.46 billion in capital raised. The highlights from our weekly IPO market updates during August 2018 included:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed