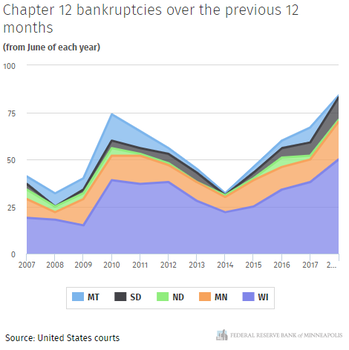

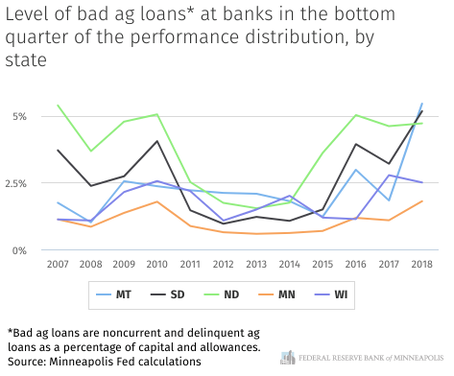

Since 2014, low agricultural prices have led to increases in chapter 12 bankruptcies in the Federal Reserve’s Ninth District, reaching levels in 2018 greater than those seen in the wake of the financial crisis. For the trailing twelve months ending June 2018, the Minneapolis Fed – overseeing Minnesota, Wisconsin, North and South Dakota, and Montana – reported 84 chapter 12 bankruptcies in its district. The last time chapter 12 bankruptcies were this high was the same period ending in 2010, which recorded 70 bankruptcies.  Not surprisingly, the four-year climb in bankruptcy filings by upper Midwestern farms falls in line with the recent fall in agricultural commodity prices. Naturally, lower sales prices by farmers makes it harder to service debt. Moreover, bankruptcies are the only sign of farm failures. The number of licensed dairy farmers in Wisconsin has fallen by about 13 percent since 2016. In fact, Wisconsin alone is responsible for 60 percent of the district’s bankruptcies. The nation’s second-largest producer of dairy has a high concentration of small dairy farms, which have greater exposure to price fluctuations than larger farms. Ultimately, this has become a pinch point for many of the region’s smaller banks who lend to these farms. Asset quality – measured by noncurrent and delinquent loans as a percentage of reserves – has been rising among the Ninth District’s 531 banks due to the increase in bad agriculture loans. Measuring the asset quality performance of the bottom quarter of the region’s banks, one can notice an inverse trend in commodity prices and chapter 12 bankruptcies. Asset quality for these banks fell suddenly following the recession, before recovering with the rise in prices. However, as prices have fallen again over the last four years, asset quality has taken another unsettling turn. This fall has been particularly strong for the Dakotas and Montana, where ag loans make up a larger portfolio of bank loans in their respective states.

0 Comments

Leave a Reply. |

Archives

August 2019

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed