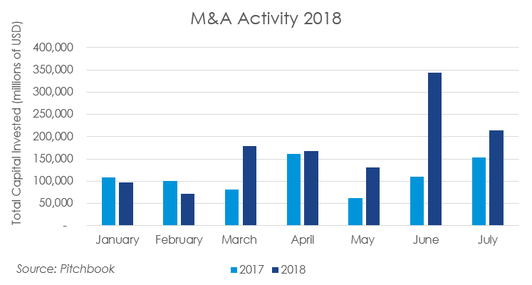

In July 2018, merger and acquisition (M&A) activity fell from yearly highs set in June. Total disclosed capital invested for mergers, acquisitions, and buyouts reached $213.9 billion in July, down 37.6% from a 2018 high of $343.2 billion invested in June. M&A capital investment has totaled $1.205 trillion year-to-date, up 55.2% from $776.4 billion in the same period of 2017. Business-to-business (B2B) companies have garnered extra attention, comprising 37% of the targets so far in 2018, and information technology (IT) companies accounted for another 19%. Deal making has climbed throughout the year thanks to a strong economy and a tax cut that provided more corporate funds for mergers, acquisitions, and buyouts. Deal-making has been particularly high in the last two months, thanks in part to fewer antitrust obstacles from regulators. Looking ahead, as the tax cut cash surge wears off and the possibility of a trade ware escalates, firms may become more reluctant to spend on deals. The highlights from our weekly M&A market updates during July 2018 included (click the links for more details):

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed